The last time raw materials like copper and oil were this cheap, an economic depression loomed just around the corner.

The last time raw materials like copper and oil were this cheap, an economic depression loomed just around the corner.

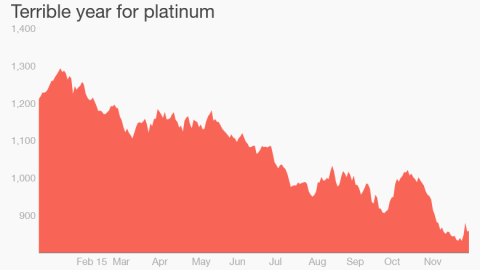

It’s no secret that commodities in general have had a horrendous 2015. A nasty combination of overflowing supply and soft demand has wreaked havoc on the industry.

But prices for everything from crude oil to industrial metals like aluminum, steel, copper, platinum, and palladium have collapsed even further in recent days. Crude oil crumbled below $37 a barrel on Tuesday for the first time since February 2009.

The situation is so bad that this week the Bloomberg Commodity Index, which tracks a wide swath of raw materials, plummeted to its weakest level since June 1999.

‘Sentiment is horrendous. It’s the worst since the financial crisis – and it’s getting worse every day,’ said Garrett Nelson, a BB&T analyst who covers the metals and mining industry.

There was fresh evidence of the sector’s financial stress from De Beers owner Anglo American (AAUKF). The mining giant said it was suspending its dividend and selling off 60% of its assets, which could lead to a reduction of 85,000 jobs.

The commodities rout is knocking stock prices, with the Dow falling over 200 points so far this week. It’s also raising concerns about the state of the global economy.

This post was published at David Stockmans Contra Corner on December 10, 2015.

Recent Comments