Bond investors appear to have placed their faith in commodities exceptionalism, with many positing that the recent pick-up in U. S. default rates will defy historical trends and remain confined to that industry.

Bond investors appear to have placed their faith in commodities exceptionalism, with many positing that the recent pick-up in U. S. default rates will defy historical trends and remain confined to that industry.

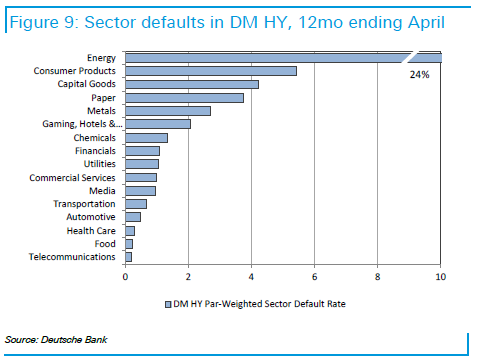

New research from Deutsche Bank AG pours cold water on that idea, arguing that there are already signs of contagion in junk-rated debt outside of the commodities space.

A look at previous peaks in default rates shows the potential for more pervasive corporate stress. While default rates were higher amongst particular sectors – such as telecoms in the early 2000s or financials during the 2008 crisis – the rate for junk bonds excluding these specialized industries also increased significantly.

This post was published at David Stockmans Contra Corner on May 24, 2016.

Recent Comments