China’s central bank chief oozed calm in an annual press briefing in Beijing Saturday, supported by weeks of composure in markets as investor anxiety over the nation’s currency policy eased.

China’s central bank chief oozed calm in an annual press briefing in Beijing Saturday, supported by weeks of composure in markets as investor anxiety over the nation’s currency policy eased.

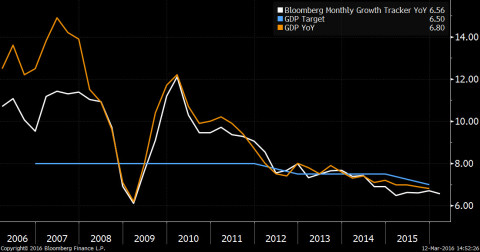

How long the lull lasts will depend on how policy makers manage a balancing act made tougher by a weaker-than-anticipated start to the year for the world’s No. 2 economy. After People’s Bank of China Governor Zhou Xiaochuan spoke at the country’s annual gathering of the legislature, data showed an ‘alarming’ failure of growth to respond to recent stimulus, Bloomberg Intelligence analysts Tom Orlik and Fielding Chen concluded.

The weakening momentum seen in industrial output and retail sales highlight skepticism about the Communist Party’s goal of achieving average growth of at least 6.5 percent in its five-year plan to 2020. Gavekal Dragonomics calls the target ‘incredible.’ JPMorgan Chase & Co. says a sustainable pace is ‘much lower’ than what officials are targeting for this year.

The danger is that to meet the leadership’s objective, which for 2016 is an expansion of 6.5 percent to 7 percent, Zhou will need to loosen monetary policy faster and further. That could intensify depreciation pressures on the yuan, which has benefited in recent weeks from a drop in the dollar.

Looming Leverage

Looser monetary policy, along with the expanded fiscal deficit pledged by Premier Li Keqiang’s cabinet, would quicken a buildup of debt that already amounts to almost 2.5 times gross domestic product.

This post was published at David Stockmans Contra Corner on March 14, 2016.

Recent Comments