Bearish P/E ratio calculation carries the most weight

Bearish P/E ratio calculation carries the most weight

The U. S. stock market’s P/E ratio is telling us in no uncertain terms that stocks are hugely overvalued. Given that, I would have thought the bulls would simply ignore it.

I was wrong.

In fact, many of the bulls have figured out how to torture the data in order to make it appear as though the stock market’s current valuation is in line with historical averages. It’s crucial that you understand what they’re doing so you don’t get seduced by their sweet-talking rationales.

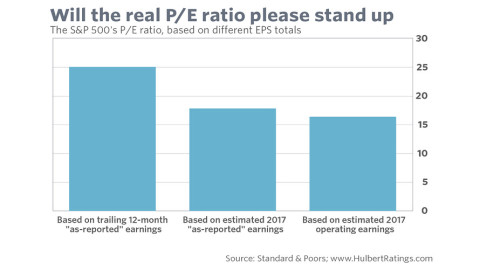

The reason the P/E can seem to tell more than one story is that there is more than one way of calculating it. Though the ‘P’ in the ratio – the price – is fixed, the ‘E’ can vary by a lot. Some analysts focus on trailing 12-month earnings, for example, while others focus on estimated earnings over the coming year. Some calculate the P/E based on earnings as they are actually reported by the companies, while others rely on so-called ‘operating earnings’ (which reflect a firm’s profits after excluding non-operating expenses such as taxes and interest).

This post was published at David Stockmans Contra Corner By Mark Hulbert, Marketwatch ‘ September 6, 2016.

Recent Comments