The flyover zones of America are wanting for work and buried in debt. That’s the legacy of three decades of Washington/Wall Street Bubble Finance. The latter has exported jobs, crushed the purchasing power of main street wages and showered the bicoastal elites with the windfalls of financialization.

The flyover zones of America are wanting for work and buried in debt. That’s the legacy of three decades of Washington/Wall Street Bubble Finance. The latter has exported jobs, crushed the purchasing power of main street wages and showered the bicoastal elites with the windfalls of financialization.

The graph below depicts the main street side of this great societal swindle at work. There are currently 126 million prime working age persons in the US between 25 and 54 years of age. That’s up from 121 million at the beginning of 2000.

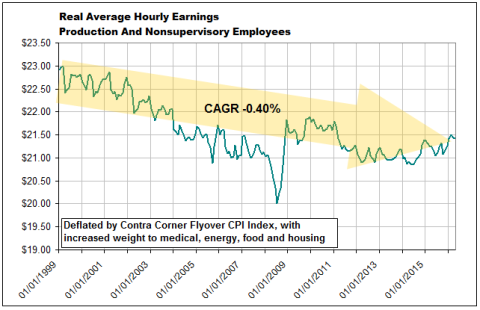

Yet even as this business cycle is rolling over, the 77.1 million employed full-time from that pool is still 1.2 million below its turn of the century level and accounts for only 61% of the population. On top of that, average real hourly wages have fallen by 7% (based on the Flyover CPI), as well.

It might be wondered, therefore, as to how real consumption expenditures rose by $3.1 trillion or 38% during the same 16-year period?

The short answer is transfer payments and debt, and those troublesome realities go right to the economic blind spots of our Keynesian monetary suzerains. These paint-by-the-numbers economic plumbers care only about the great aggregates of spending and whether or not the bathtub of so-called ‘full employment GDP’ is being filled to the brim.

As a consequence, the ideas of quality, sustainability, efficiency, discipline, prudence or, for that matter, even economic justice and equity, never enter the narrative. It matters not a wit whether the considerable expansion of PCE depicted above originated in disability checks, second mortgages, car loans at 120% loan-to-value – -or even if it was deposited by a passing comet.

What counts is the incremental gains in GDP compared to last quarter and proxies for demand such as job counts and housing starts versus prior month. And when the business cycle eventually ends, there is always a scape-goat to blame, such as an oil price shock or Wall Street meltdown.

By contrast, no Fed head ever asked whether real PCE growth of nearly two-fifths during a period when the number of prime-age full-time workers went down and real wage rates dropped was healthy or sustainable.

This post was published at David Stockmans Contra Corner on June 1, 2016.

Recent Comments