When the Bank of Japan unexpectedly announced negative interest-rate policies in January, the first thing Tomomi Sato did was withdraw a 10th of the money in her bank account and stash it at home.

When the Bank of Japan unexpectedly announced negative interest-rate policies in January, the first thing Tomomi Sato did was withdraw a 10th of the money in her bank account and stash it at home.

‘It made me think of bank runs and shutdowns like I’ve heard there were in the past,’ said the 30-something assistant to manga comic artists, who commutes for two hours from a small apartment in Tokyo’s suburbs. ‘Eventually, I feel like they’ll start charging me to keep my money there. When I think about that, I begin to worry.’

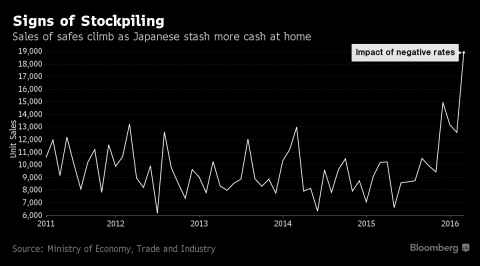

Sato is emblematic of a challenge facing the central bank that rates below zero only deepened: average Japanese aren’t feeling the benefits of more than three years of extraordinary monetary stimulus, and cash withdrawals suggest they are losing faith. About 40 trillion yen ($360 billion) has piled up in homes across Japan, according to a Dai-ichi Life Research Institute estimate – equivalent to about 8 percent of gross domestic product. That’s money banks could be lending on or using to buy bonds.

This post was published at David Stockmans Contra Corner on June 1, 2016.

Recent Comments