Money markets are flashing warning signals as rising credit risk, spurred in part by fears of Brexit, makes it harder for big banks to obtain U. S. dollar funding.

Money markets are flashing warning signals as rising credit risk, spurred in part by fears of Brexit, makes it harder for big banks to obtain U. S. dollar funding.

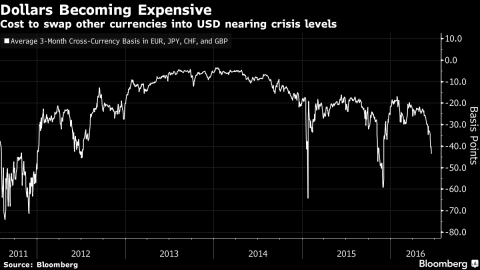

A gauge of bank borrowing costs – the FRA/OIS spread – hit the most extreme level since 2012 on Thursday, and the premium to swap foreign currencies into dollars reached the highest since late last year as deteriorating investor sentiment ahead of Britain’s June 23 referendum on European Union membership strained the financial system.

The latest bout of turmoil illustrates how regulatory changes introduced after the financial crisis are leading to greater volatility in episodes of stress. Banks, facing higher costs to make markets, aren’t stepping in as they did in the past to take advantage of arbitrage opportunities in funding markets, leading to bigger price movements.

This post was published at David Stockmans Contra Corner on June 17, 2016.

Recent Comments