Norway’s massive wealth fund is projected to get smaller this year for the first time since early last decade.

Norway’s massive wealth fund is projected to get smaller this year for the first time since early last decade.

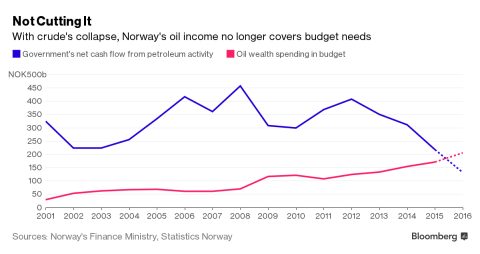

Budget documents on Wednesday showed the government expects the fund to shrink about 4 percent to 7.15 trillion kroner ($881 billion) at the end of 2016 after ending last year at 7.46 trillion kroner.

This historic projection comes as the fund is being bludgeoned on nearly all sides. Most pressing is probably that its returns from the 35 percent it must hold in bonds has all but evaporated amid negative yields across Europe. A rebound in the krone could also press down its value domestically as its foreign investments become worth less.

‘The fixed-income part has low returns in a situation where the bond yields are as low as they are and there’s been a lot of turbulence in the stock markets,’ Finance Minister Siv Jensen said in an interview on Wednesday. ‘But over time, the results of the global pension fund have been very good, and we are a long-term investor and can handle short-term fluctuations.’

This post was published at David Stockmans Contra Corner on May 16, 2016.

Recent Comments