There’s a huge bubble at the bottom of the bond market, and when it pops it could put $1 trillion at risk.

There’s a huge bubble at the bottom of the bond market, and when it pops it could put $1 trillion at risk.

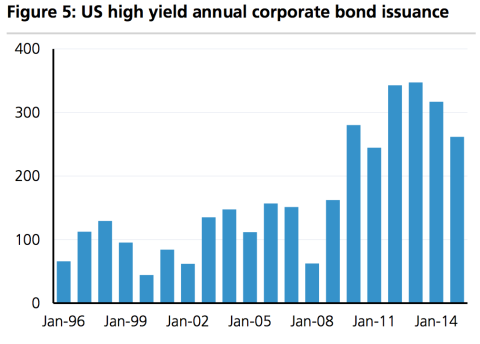

‘In short, we believe there is a corporate credit bubble in speculative grade credit. And the structural downside risks for high yield bonds and loans are material, with non-negligible downside risks to growth,’ UBS’ Matthew Mish wrote in a note to clients.

Mish argued that below the surface of corporate bonds, all the way down at the bottom-most levels of junk, there is a bubble forming.

‘We believe roughly 40% of all issuers are of the lowest quality, and roughly $1tn which will end up ‘distressed debt’ in this cycle,’ Mish wrote. ‘Much of the debt was bought to pick-up yield linearly, but the default risk is exponential.’

So how did we get here? Mish believes there are three circumstances that have inflated the bubble:

This post was published at David Stockmans Contra Corner on May 2, 2016.

Recent Comments