For all the upbeat forecasts about the growth of solar power, this is a punishing year for the industry. And it won’t improve anytime soon.

For all the upbeat forecasts about the growth of solar power, this is a punishing year for the industry. And it won’t improve anytime soon.

SunEdison Inc., the world’s biggest clean-energy company, is bankrupt. Yingli Green Energy Holding Co., once the top panel maker, warned it may be inching toward default. And SolarCity Corp., the largest U. S. rooftop installer, plunged as much as 27 percent Tuesday after scaling back its installation forecast for the third time in seven months.

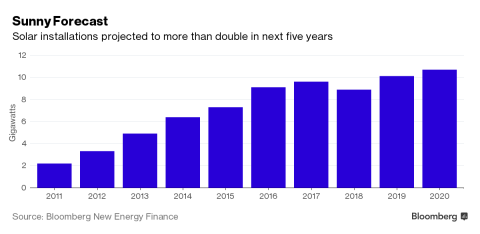

They’re not alone. A Bloomberg index of 20 major solar companies has slumped more than 30 percent this year. Soaring installations and growing global demand for clean energy is being trumped by investor concerns that the debt-fueled strategies employed by SunEdison, Yingli and SolarCity are endemic to the industry and dangerous for shareholders.

‘They call it the solarcoaster for a reason,’ said Nancy Pfund, managing partner of DBL Partners and a SolarCity director. With so much happening, both positive and negative, ‘it’s been hard for investors to follow.’

At a time when falling prices, renewed U. S. tax breaks and the Paris climate deal are fueling solar sales worldwide, solar shares are performing even worse than coal stocks.

This post was published at David Stockmans Contra Corner on May 10, 2016.

Recent Comments