Italy is running out of economic time. Seven years into an ageing global expansion, the country is still stuck in debt-deflation and still grappling with a banking crisis that it cannot combat within the paralyzing constraints of monetary union.

Italy is running out of economic time. Seven years into an ageing global expansion, the country is still stuck in debt-deflation and still grappling with a banking crisis that it cannot combat within the paralyzing constraints of monetary union.

‘We have lost nine percentage points of GDP since the peak of the crisis, and a quarter of our industrial production,’ says Ignazio Visco, the rueful governor of the Banca d’Italia.

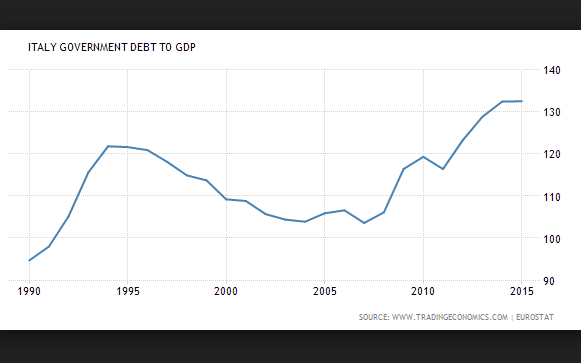

Each year Rome hopefully pencils in a fall in the ratio of public debt to GDP, and each year the ratio rises. The reason is always the same. Deflationary conditions prevent nominal GDP rising fast enough to outgrow the debt.

The putative savings from drastic fiscal austerity – cuts in public investment – were overwhelmed by the crushing arithmetic of the ‘denominator effect’. Debt was 121pc in 2011, 123pc in 2012, 129pc in 2013.

It came close to levelling out last year at 132.7pc, helped by the tailwinds of a cheap euro, cheap oil, and Mario Draghi’s fairy dust of quantitative easing. This triple stimulus is already fading before the country escapes the stagnation trap. The International Monetary Fund expects growth of just 1pc this year.

The global window is closing in any case. US wage growth will probably force the Federal Reserve to raise interest rates and wild speculation will certainly force China to rein in its latest credit boom. Italy will enter the next downturn – perhaps early next year – with every macro-economic indicator in worse shape than in 2008, and half the country already near political revolt.

This post was published at David Stockmans Contra Corner on May 12, 2016.

Recent Comments