Nobody rings a bell at the top of the credit supercycle, to misuse an old adage. Except that this time somebody very powerful in China has done exactly that.

Nobody rings a bell at the top of the credit supercycle, to misuse an old adage. Except that this time somebody very powerful in China has done exactly that.

China watchers are still struggling to identify the author of an electrifying article in the People’s Daily that declares war on debt and the ‘fantasy’ of perpetual stimulus.

Written in a imperial tone, it commands China to break its addiction to credit and take its punishment before matters spiral out of control. If that means bankruptcies must run their course, so be it.

Fifteen years ago such a mystery article would have been an arcane matter, of interest only to Sinologists. Today it is neuralgic for the entire global – and over-globalized – financial system.

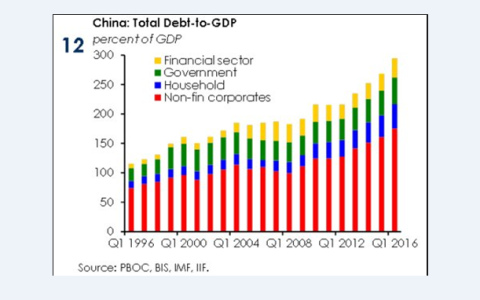

China’s debt is approaching $30 trillion. The fresh credit alone created since 2007 is greater than the outstanding liabilities of the US, Japanese, German, and Indian commercial banking systems combined.

Moody’s warned this month that China’s state-owned entities (SOEs) have alone racked up debts of 115pc of GDP, and a fifth may require restructuring. The defaults are already spreading up the ladder from local SOE’s to the bigger state behemoths, once thought – wrongly – to have a sovereign guarantee.

This post was published at David Stockmans Contra Corner on May 19, 2016.

Recent Comments