Just as monetary easing is pushing Chinese bond yields to record lows, the ability of listed companies to service their debt has dropped to the weakest on record.

Just as monetary easing is pushing Chinese bond yields to record lows, the ability of listed companies to service their debt has dropped to the weakest on record.

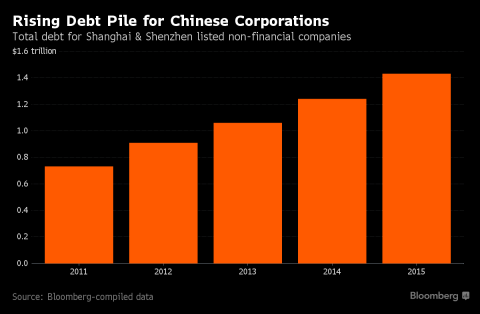

Firms generated just enough operating profit to cover the interest expenses on their debt twice, down from almost six times in 2010, according to data compiled by Bloomberg going back to 1992 from non-financial companies traded in Shanghai and Shenzhen. Oil and gas corporates were the weakest at 0.24 times, followed by the metals and mining sector at 0.52.

The People’s Bank of China has lowered benchmark interest rates six times since 2014, driving a record rally in the bond market and underpinning a jump in debt to 247 percent of gross domestic product. Yet economic growth has slumped to the slowest in a quarter century and profits for the listed companies grew only 3 percent in 2015, down from 11 percent in 2014. The mounting debt burden has caused at least seven firms to miss local bond payments this year, already reaching the tally for the whole of last year.

‘We will likely see a wave of bankruptcies and restructurings when the interest coverage ratio drops further,’ said Xia Le, chief economist for Asia at Banco Bilbao Vizcaya Argentaria SA in Hong Kong. ‘Return on assets for Chinese companies has been declining due to rising debt. Profitability is also slowing due to overcapacity in many sectors, which has weakened the ability of companies to repay their debts.’

This post was published at David Stockmans Contra Corner on April 14, 2016.

Recent Comments