The spectacular economic rise of the top 1 percent is now common knowledge, thanks in large part to the work of Thomas Piketty and his collaborators. The top 1 percent of U. S. residents now earn 21 percent of total national income, up from 10 percent in 1979.

The spectacular economic rise of the top 1 percent is now common knowledge, thanks in large part to the work of Thomas Piketty and his collaborators. The top 1 percent of U. S. residents now earn 21 percent of total national income, up from 10 percent in 1979.

Curbing this inequality requires a clear understanding of its causes. Three of the standard explanations – capital shares, skills, and technology – are myths. The real cause of elite inequality is the lack of open access and market competition in elite investment and labor markets. To bring the elite down to size, we need to make them compete.

Myth 1: Capital vs. labor share

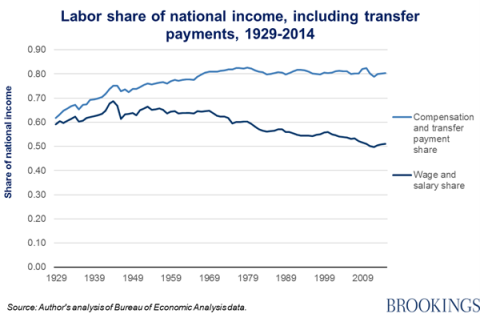

In his recent and otherwise valuable book, Saving Capitalism: For the Many, not the Few, Robert Reich claims that the share of income going to workers has fallen from 50 percent in 1960 to 42 percent in 2012. Meanwhile, corporate profits have risen. In short: trillions of dollars have gone to capitalists instead of workers. The sensible policy responses, as Reich and others have stressed, are to increase taxes on corporate income and capital gains, and widen capital ownership.

These might be a good idea for other reasons, but the basic facts currently being used to justify them are wrong. Between 1980 and 2014, corporate profits actually represented alower share of GDP (4.9 percent) than between 1950 and 1979 (5.4 percent).

Income from the main four capital sources – dividends, interest, rental income, and proprietor income – has nudged upwards as a share of GDP by just one percentage point between these two periods, and entirely because of higher interest income, which mainly goes to retirees who own Treasury bonds.

This post was published at David Stockmans Contra Corner on April 5, 2016.

Recent Comments