Companies around the world will be forced to add close to $3tn of leasing commitments to their balance sheets under new rules from US and international regulators – significantly increasing the net debt that must be reported by airlines and retailers.

Companies around the world will be forced to add close to $3tn of leasing commitments to their balance sheets under new rules from US and international regulators – significantly increasing the net debt that must be reported by airlines and retailers.

A new financial reporting standard – the culmination of decades of debate over ‘off-balance sheet’ financing – will affect more than one in two public companies globally.

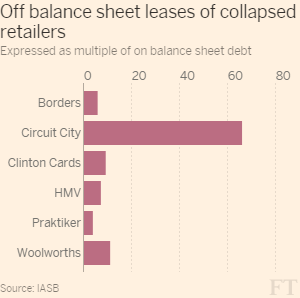

Worst hit will be retail, hotel and airline companies that lease property and planes over long periods but, under current accounting standards, do not have to include them in yearly reports of assets and liabilities.

In these sectors, future payments of off-balance sheet leases equate to almost 30 per cent of total assets on average, according to the International Accounting Standards Board, which collaborated with the US Financial Accounting Standards Board on the new rule.

Hans Hoogervorst, IASB chairman, said: ‘The new Standard will provide much-needed transparency on companies’ lease assets and liabilities, meaning that off-balance-sheet lease financing is no longer lurking in the shadows’.

This post was published at David Stockmans Contra Corner By Kate Burgess, Hariet Agnew & Scheherazade Daneshkhu Financial Times ‘ January 13, 2016.

Recent Comments