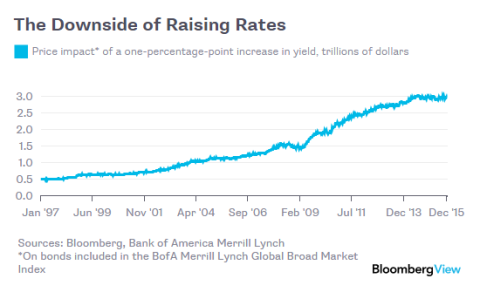

With any luck, the world economy will eventually be strong enough for central banks to follow the U. S. Federal Reserve in ending what has been an unprecedented period of extremely low interest rates. If and when they do, they’ll run straight into the same issue that the Fed now faces: Raising rates will precipitate unusually large losses for investors.

With any luck, the world economy will eventually be strong enough for central banks to follow the U. S. Federal Reserve in ending what has been an unprecedented period of extremely low interest rates. If and when they do, they’ll run straight into the same issue that the Fed now faces: Raising rates will precipitate unusually large losses for investors.

Over the past several years, investors have gone to great lengths in their search for returns in a low-rate environment. They’ve done so in part by buying longer-maturity bonds, which tend to offer higher yields but are also more sensitive to changes in rates. One gauge of this risk is effective duration, which estimates the percentage decline in a bond’s price given a one-percentage-point increase in yield. The measure is near all-time highs in the U. S., according to a report issued last week by the Office of Financial Research.

This post was published at David Stockmans Contra Corner on December 23, 2015.

Recent Comments