Last night’s Asia action brought another warning that the global deflation cycle is accelerating. Iron ore broke below $40 per ton for the first time since the central banks kicked off the world’s credit based growth binge two decades ago; it’s now down 40% this year and 80% from its 2011-212 peak.

Last night’s Asia action brought another warning that the global deflation cycle is accelerating. Iron ore broke below $40 per ton for the first time since the central banks kicked off the world’s credit based growth binge two decades ago; it’s now down 40% this year and 80% from its 2011-212 peak.

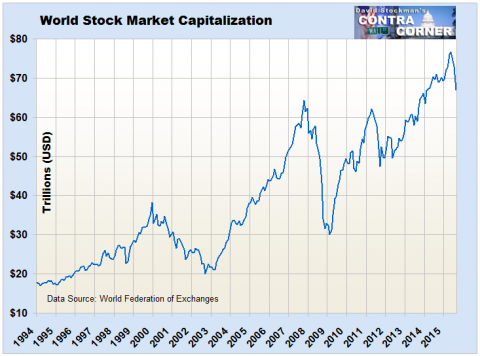

As the man said, however, you ain’t seen nothin’ yet. That’s because the above chart is not merely reflective of too much supply and capacity growth enthusiasm in the iron ore industry or even some kind of worldwide commodity super-cycle that has gone bust.

Instead, the iron ore implosion is symptomatic of a much deeper and more destructive malady. Namely, it reflects the monumental malinvestment generated by two decades of rampant credit expansion and falsification of debt and equity prices by the world’s convoy of money printing central banks.

This post was published at David Stockmans Contra Corner by David Stockman ‘ November 30, 2015.

Recent Comments