Yesterday’s WSJ article on rising auto loan delinquencies had a familiar ring. It focused on sub-prime borrowers who were missing payments within a few months of the vehicle purchase. Needless to say, that’s exactly the manner in which early signs of the subprime mortgage crisis appeared in late 2006 and early 2007.

Yesterday’s WSJ article on rising auto loan delinquencies had a familiar ring. It focused on sub-prime borrowers who were missing payments within a few months of the vehicle purchase. Needless to say, that’s exactly the manner in which early signs of the subprime mortgage crisis appeared in late 2006 and early 2007.

More than 8.4% of borrowers with weak credit scores who took out loans in the first quarter of 2014 had missed payments by November, according to the Moody’s analysis of Equifax credit-reporting data. That was the highest level since 2008, when early delinquencies for subprime borrowers rose above 9%.

To be sure, subprime auto will never have the sweeping impact that came from the mortgage crisis. The entire auto loan market is less than $1 trillion compared to a mortgage market of more than $10 trillion at the time of the crisis.

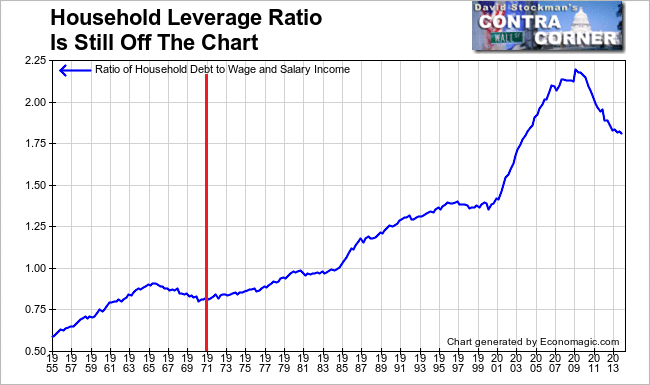

Yet the salient point is the same. The apparent macro-economic recovery and prosperity of 2004-2008 rested on the illusion of an unsustainable debt fueled housing boom; this time its the auto sector.

Indeed, delete the auto sector from the phony 5% GDP SAAR of Q3 2014 and you get an economy inching forward on its own capitalist hind legs. Q3 real GDP less motor vehicles was up just 2.3% from the prior year (LTM); and that’s the same LTM rate as recorded in Q3 2013, and slightly lower than the 2.4% growth rate posted in Q3 2012.

This post was published at David Stockmans Contra Corner on January 9, 2015.

Recent Comments