The speculators that traded $261 billion in Chinese commodities in a single day last week are retreating as regulators prepare to step up control of the market.

The speculators that traded $261 billion in Chinese commodities in a single day last week are retreating as regulators prepare to step up control of the market.

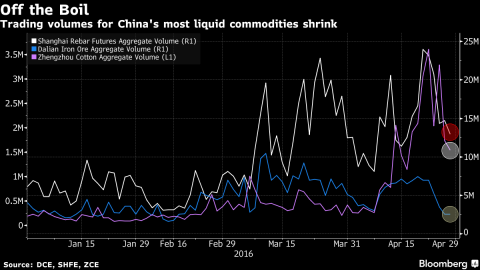

The value of futures traded across China’s three biggest commodity exchanges has shrunk 42 percent since investors spent 1.7 trillion yuan last Thursday on everything from steel bars to eggs. The amount that changed hands was on a par with the entire U. S. equities market on the same day.

Markets in the world’s biggest consumer of raw materials have been gripped by a trading frenzy that’s drawn comparisons with the credit-driven stock market rally last year that preceded a $5 trillion rout. Exchanges have responded by raising margins and transaction fees to curb speculation while the securities regulator is said to have prepared measures to limit price fluctuations.

‘They unleashed this torrent of regulatory moves in the name of curbing speculation, but the long-term impact on this marketplace is uncertain,’ Fan Qingtian, an analyst at Nanhua Futures Co., said by phone from Hangzhou. ‘The short-term impact is that many investors who have been caught in the middle are trying to exit their positions.’

This post was published at David Stockmans Contra Corner on April 29, 2016.

Recent Comments