Stock buybacks, which have helped power the 7-year-old bull market, are showing their first signs of retreat in at least three years.

Stock buybacks, which have helped power the 7-year-old bull market, are showing their first signs of retreat in at least three years.

Share repurchases decreased 3.4 percent in the fourth quarter from the previous three-month period and are tracking at a 21-month low in March, according to respective data from S&P Dow Jones Indices and TrimTabs.

If the trend continues, that would mark a major trend shift. Companies have been using reductions in share count as a way to boost earnings profiles, raise stock prices and reward corporate executives. The programs have been seen as a major driver of the market rally, though the extent of the effect has come under scrutiny in recent months.

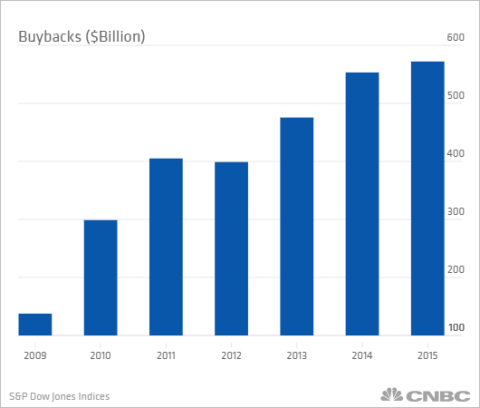

The most recent trend shows that buybacks have dwindled to $23.5 billion in March, just a month after hitting a 10-month high of $94.6 billion in February, TrimTabs reported in its weekly market summary. S&P 500companies have committed more than $2.7 trillion to buybacks since the market bottomed back in March 2009.

For all of 2015, share repurchases totaled $572.2 billion, an increase of 3.4 percent from 2014.

This post was published at David Stockmans Contra Corner on March 30, 2016.

Recent Comments