As questions mount about the viability of Valeant Pharmaceuticals International Inc.’s business model, concerns are spreading to other drug makers seen as following a similar playbook.

As questions mount about the viability of Valeant Pharmaceuticals International Inc.’s business model, concerns are spreading to other drug makers seen as following a similar playbook.

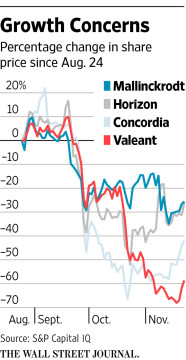

Shares of Horizon Pharma PLC and Mallinckrodt PLC, two of the largest companies most often compared with Valeant, have fallen roughly 25% in the past three months. Shares of Concordia Healthcare Corp., a younger company based in Ontario, Canada, are down 42%. Combined, the three companies have shed more than $4 billion in market value since late August, according to S&P Capital IQ data.

Like Valeant, the firms are part of a new breed of pharmaceutical company that has limited costly investment in research and development and instead sought sales growth through debt-fueled acquisitions – often of older drugs for which they raise prices sharply. In recent years, the companies’ share prices surged as many investors embraced their business models.

But investors are concerned that the companies’ growth could be curtailed by any new government price controls, or by increased pressure from powerful pharmacy-benefit managers, which manage drug spending for employers and health insurers. Some of the companies’ aggressive strategies for ensuring their drugs reach patients have also come under scrutiny, such as working with pharmacies to help handle patients’ reimbursement and copay issues. Pharmacy-benefit managers, including Express Scripts HoldingCo., have in recent weeks terminated contracts with pharmacies that dispensed high-price drugs made by Valeant or Horizon.

This post was published at David Stockmans Contra Corner on November 23, 2015.

Recent Comments